What a relief

Pension planning doesn’t need to be complicated. What you do need is a pension plan administrator to provide strong support services, deep expertise and a modern employee experience.

Here’s the Challenge

Pensions can be hard to navigate

Here’s how we solve it

Upgrade the pension experience

See more of what’s possible with our Defined Benefit solution

For employers

We keep your defined benefit plan running smoothly with complete strategy and support, including digital tools, insights and guidance.

Benefits

- Track plans and reporting on the plan sponsor portal

- Support a full range of transactions

- Stay current with compliance, regulations and stewardship

- Manage third-party interactions

- Customize and automate calculations

- Support pension de-risking with help on a full scope of project management tactics

- Data security for your human capital

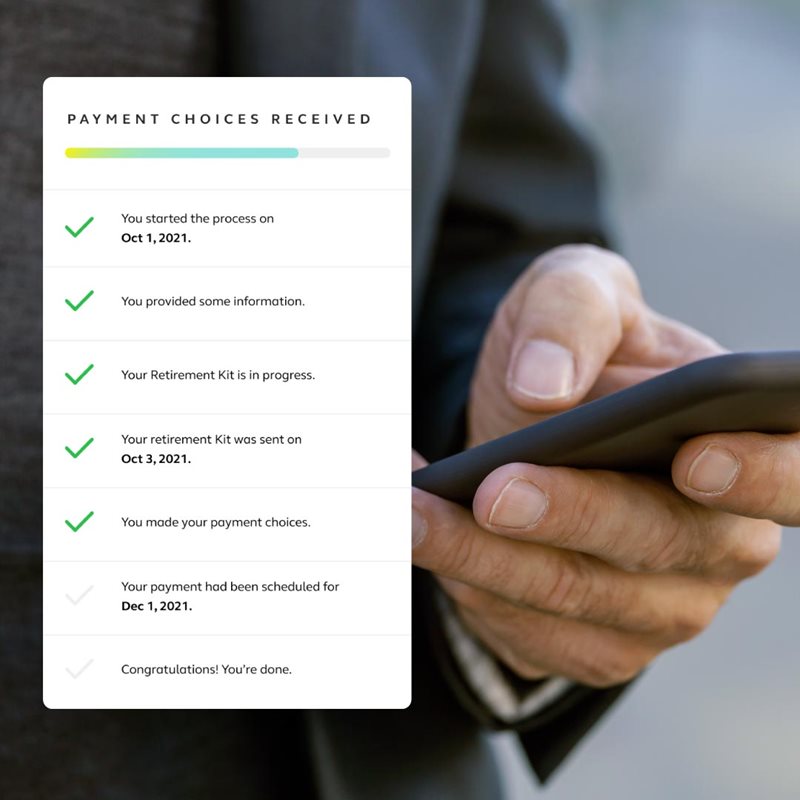

For employees

Your people don’t have to manage their plan on their own. As their pension plan administrator, we have tools and information at the ready to help them make decisions and educate them about their plans. They can also take advantage of plan reporting, benefit calculation and retirement income estimating and modeling.

Benefits

- Track retirement and set appointments virtually on one portal

- Estimate retirement expenses and income with proprietary projections tool

- Receive live support from trained, friendly customer service representatives

- Get answers to questions in all phases of retirement via Service Center

Ready to get started?

Learn more about how we can help your business.

Recommended insights

Explore our other solutions

Defined Contribution

Guide your people to better financial outcomes and get help managing your plan.

Financial Wellbeing

Knowledge, tools and advisory support to help people meet their financial goals.